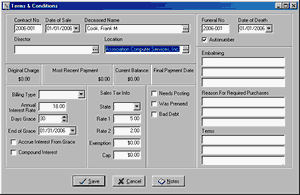

To add Sales Tax, click the Sales Tax button on the right hand side of the Original Charges tab sheet.

The rules for calculating Sales Tax are determined by the Contract and the individual items. The tax rates are specified in the Contract.

The Tax State is the two letter abbreviation for the State whose tax rules apply to this contract. Tax Rate 1 is the rate which will be applied to Items which have Taxable 1 checked. Tax Rate 2 will be applied to Items with Taxable 2 checked. Exemption and Cap are only needed in a few states so if these terms are unfamilar, you probably should skip these fields.

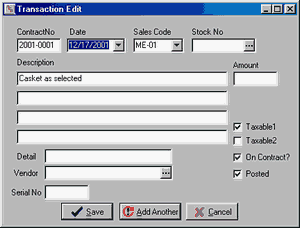

The following screen shows a merchandise item with Taxable 1 checked.

By default Taxable 1 is checked for Merchandise items; you may change the default conditions of the Tax checkboxes by modifying the Sales Codes.